Latest Blogs

In the information age, data is the calorie that drives business decisions. Just as there are good calories and bad calories, not all data is equal. As more and more companies use data to drive their decision-making processes, getting quality data is crucial to their success.

Data science has been around since the 1980s, in the form of concepts such as data warehousing. If you scour the internet, looking for advice on getting better data quality, you’ll find long-standing concepts such as metrics of accuracy and timeliness along with recent tactical advice on how to sanitize data using Python or R. How do we better navigate through this dizzying array of information?

Here are five steps you can take today to improve the quality of your data.

Step 1: Define Your Usefulness Metrics

To help managers make better decisions faster or to help employees be more responsive, you must define what “useful data” looks like.

These are the most common metrics we use to define useful data:

- Accuracy

- Precision

- Completeness

- Validity

- Relevancy

- Timeliness

- Ability to be understood

- Trustworthiness

Step 2: Profiling

Profiling involves analyzing the data you’re working with in order to clarify its structure, content, relationships, and derivation rules. This is a crucial step for machine learning because users typically have an intuitive understanding of how data is interrelated. However, machines currently need precise instructions so it’s necessary to profile the data at hand and make it work for your user via data analysis software.

To begin, you should clarify how different data points are related to one another. How do you want to group and structure them? What rules do you want to apply to the data to derive for display purposes? These steps are typical when performing a data profile.

After you’ve performed in-depth profiling, you may continue to perform detailed profiling. This is because continuous detailed profiling helps determine the appropriate data for extraction and the appropriate filters to apply to your data set.

After you load the data into memory, you may want to continue profiling the data to ensure that it is correctly sanitized and transformed to comply with your requirements.

Step 3: Standardization

Standardizing data is another crucial step for improving quality. Standards help improve communication among teams.

Good communication requires the ability to deliver complex information clearly and concisely, with minimal confusion. This is true for conveying your data to your audience.

There are two types of standards: external and internal. External standards (as in outside your organization) are appropriate for commonly used data types like datetime. For example, if you wanted to represent datetime, you’d choose a widely accepted international standard like ISO-8601. I’d advise you not to invent your own standards needlessly and don’t choose obscure standards. Remember, your goal is to communicate data easily and effectively. Therefore, external standards such as ISO-8601 should be chosen wisely.

In some situations, you may need to create your own internal standards. It takes more work, but it is possible to do so. Internal standards also help improve communications within your company. They can also serve another purpose—for example, imagine that your business has a revolutionary process that allows you to ship twice as fast as your competitors. This is a huge competitive edge for you and will likely require the entire company to work within this revolutionary process; however, if the same vocabulary is consistently applied in the data as well then there is a good chance that your staff will stay on the same page and work within the new paradigm that has been created.

Step 4: Matching or Linking

If you have properly defined your data model and performed profiling, but your audience is still not getting the kind of useful insights they thought they would, then you need to add matching and linking capabilities.

Recall that we talked about relationships and the structure of your data earlier, in Step 2: Profiling. You need to show your audience the relationships you discover in your data. When the relationships are in place, your audience will be able to perform a wide array of operations on the data, rolling up, drilling down, and slicing and dicing the data as they need. In other words, they’ll have business intelligence via online analytic processing.

Imagine being able to analyze sales data that is tied to customers’ demographics, as well as product inventory. Now you will be able to predict trends and buy patterns based on product, transaction time, or demographics. It’s the same group of data but it can be analyzed in three different ways.

Step 5: Monitoring

The work of a good data analyst is never done. You need to constantly monitor the changes in the data you receive, analyze those changes and adjust your analysis accordingly. Changes may be brought about by a new competitor in the scene, or maybe there’s a change in regulation. Technology advances may also cause you to change your data analysis process.

Software and data can decay, too. Continuous profiling may lead you to change your policy in order to remain competitive. New standards may need to be introduced to meet those standards.

Monitoring data is crucial. If there is any doubt about the integrity of your data, it should be thoroughly checked before it is used. There are many tools available to help alleviate this workload; one example is software that sends notifications to departments responsible for collecting or sanitizing data whenever your monitoring software picks up anomalies such as wrongly inputted data.

Now that you know the five steps for improving your data quality control, take note of which ones you’re already doing well and put in place a quarterly review process to ensure that you’re continually evaluating your data quality control. This way, you’ll always be seeing where you stand and where you can improve.

In today’s fast-paced digital age, where brands are vying for consumer attention across platforms, advertising research has become more critical than ever. Businesses need data-driven insights to evaluate, optimize, and refine their advertising strategies—and that’s where an expert advertising research company comes into play. Cogentix Research, a trusted name in

Amazon and Apple Beat Earnings Estimates, But Forecasts Raise Concerns Amid Tariff Uncertainty

The tech giants Amazon and Apple have once again outperformed Wall Street’s expectations in their latest quarterly earnings reports. However, both companies have issued cautious outlooks for the coming months, citing growing uncertainty around tariffs and global trade policies. Here’s a breakdown of what’s driving the headlines-and what it means

In today’s fast-moving digital world, numbers and charts alone don’t tell the whole story. If you’ve ever watched a customer share their experience on video-or seen a brand’s story come alive through rich media-you know the difference is more than visual. Video and rich media are transforming market research, making

In recent years, the focus on health and wellness has skyrocketed, evolving from a niche market into a global movement. As we step into 2025, consumers are increasingly prioritizing their physical and mental well-being, shaping the landscape of health-related products and services. This blog explores the latest trends in health

The Critical Role of Pre and Post Campaign Research in Effective Marketing Strategy

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry In the fast-paced world of modern marketing, success doesn’t just happen overnight. It requires strategy, data, and continuous improvement. This is where pre and post-campaign research comes into play. With the right market research and analytics tools,

Differences between Qualitative and Quantitative Research Explained: A Comprehensive Guide for Hybrid Market Research and Analytics

In today’s data-driven world, market research has become a crucial tool for businesses to understand consumer behaviour, measure customer satisfaction, and forecast market trends. The two primary methodologies for conducting market research are qualitative research in India and quantitative research. Both are essential for gathering insights, but they serve different

The Role of Qualitative Research in a Quantitative World

In today’s data-driven environment, businesses often prioritize quantitative data to drive decision-making. However, qualitative research plays an indispensable role in understanding the deeper motivations and emotions behind consumer behavior. As a market research company, recognizing the importance of qualitative insights can set your business apart from competitors. This blog explores how qualitative

Building a Brand Through Market Research

In today’s competitive business landscape, understanding your target market is more critical than ever. Effective market research serves as the foundation for building a strong brand that resonates with consumers. In this blog post, we’ll explore how market research can enhance brand development and positioning, providing you with actionable insights to create

Understanding the Importance of Brand Health and Brand Tracking:

How Data Analytics and Research Shape Success A strong brand is not just built on great products or services, but on understanding the heartbeats of your consumers. Brand health and tracking are the compass that guide you through the ever-changing landscape of market demands. Introduction In today’s competitive market, maintaining

The Future of Quantitative Research in India: Trends, Challenges, and Opportunities

Qualitative Research in India is undergoing a massive transformation in India. As businesses become more data-driven, the demand for robust Market Research Services in India and analytics solutions is booming. With global technology integration, innovative data sampling techniques, and the rise of hybrid research methodologies combining qualitative and quantitative insights,

Why Market Research is Crucial for FMCG Brands: A Key to Success in Today’s Dynamic Market

In the ever-evolving world of Fast-Moving Consumer Goods (FMCG), staying ahead of the competition is not just about offering quality products. It requires a deep understanding of consumer behavior, market trends, and strategic insights that drive business decisions. This is where market research plays a crucial role. By providing essential

Top Benefits of Advertising Research for Startups

In today’s highly competitive business landscape, advertising is more than just a creative endeavor — it’s a strategic necessity. For startups especially, where resources are limited and competition is fierce, every marketing decision needs to be backed by solid data. This is where advertising research steps in as a game-changer.

In 2025, sustainability and ESG (Environmental, Social, Governance) are no longer optional—they are central to consumer choices, brand loyalty, and business growth. Today’s consumers are more informed, values-driven, and willing to reward brands that authentically commit to sustainable practices. Here’s how these trends are reshaping the market and what businesses

How Online Consumer Panels Drive Better Marketing Decisions

In today’s data-driven market landscape, understanding consumer behavior is no longer optional—it’s essential. One of the most powerful tools marketers have at their disposal is the online consumer panel. These panels provide valuable, real-time insights directly from the target audience, helping businesses make smarter, faster, and more effective marketing decisions.

Imagine a world where every ad you see is tailored to your preferences, habits, and even moods. This isn’tthe future—it’s happening now. With 88% of marketers using AI daily, modern marketing has evolved fromintuition to data-driven precision. AI is revolutionizing consumer research, enabling businesses to analyzevast datasets for deeper insights,

With over 3.5 billion social media users sharing their thoughts daily, brands have a goldmineof insights at their fingertips. Social media listening has become essential for understandingconsumer sentiment, behavior, and emerging trends in real-time. The Rise of Social Media ListeningThe global social listening market is projected to grow from $9.61

India is a diverse and dynamic marketplace with ever-changing consumer behaviors, regional preferences, and cultural influences. To truly understand what drives purchasing decisions, businesses need deeper insights beyond numbers and statistics. This is where Qualitative Research in India plays a crucial role. At Cogentix Research, we specialize in qualitative research

Innovative Sampling Techniques for Hard-to-Reach Populations

Reaching hard-to-reach populations—such as marginalized groups, hidden communities, or niche demographics—requires innovative sampling strategies that go beyond traditional methods. These populations often lack visibility, are geographically dispersed, or may be hesitant to participate in research due to stigma or mistrust. Below are some advanced and creative techniques tailored for effective

The Role of Neuromarketing in Understanding Consumer Behavior

Neuromarketing, sometimes referred to as consumer neuroscience, represents a revolutionary approach to understanding consumer behavior by examining brain activity and physiological responses to marketing stimuli. This interdisciplinary field combines principles from neuroscience, psychology, and marketing to provide deeper insights into consumer decision-making processes that traditional research methods cannot access. Core

Gamification Techniques in Market Research: Increasing Participation and Data Quality

Market research gamification has evolved significantly, transforming traditional data collection methods into engaging experiences that yield higher quality insights. By incorporating game mechanics into research activities, organizations are seeing substantial improvements in participation rates, data quality, and respondent satisfaction. Key Gamification Techniques Points and Rewards Systems Implementing points and rewards

Micro-Content Creation for Research Dissemination

In today’s fast-paced digital environment, effectively disseminating research findings requires more than traditional academic papers. Micro-content—concise, impactful pieces of information designed for quick consumption—has become essential for researchers looking to expand their reach and influence. Understanding Micro-Content for Research Micro-content refers to bite-sized information that delivers critical insights in a

Ethical Considerations in AI-Powered Sentiment Analysis

AI-powered sentiment analysis has become a powerful tool for interpreting emotions and opinions from text and speech, but its implementation raises significant ethical concerns that must be addressed. As we navigate through 2025, these considerations have become increasingly important for responsible deployment of this technology. Privacy and Consent One of

The Impact of Zero-Click Content on Market Research Data Collection

Zero-click content has fundamentally altered how consumers interact with information online, creating significant implications for market research data collection methodologies. As we move through 2025, this trend continues to reshape how researchers must approach gathering consumer insights. Understanding Zero-Click Content Zero-click content refers to information designed to provide immediate value

Branding and Marketing Strategy Company: Elevate Your Business with Cogentix Research

In today’s competitive landscape, having a strong brand and an effective marketing strategy is essential for business success. At Cogentix Research, we specialize in helping businesses build a powerful brand presence and execute data-driven marketing strategies to drive growth and customer engagement. Whether you are a startup or an established

Advertising Research Company: The Role of Cogentix Research in Transforming Marketing Insights

In today’s rapidly evolving business landscape, staying ahead of consumer behavior and market trends is no longer optional—it’s essential. This is where an advertising research company like Cogentix Research steps in, redefining how brands connect with their audiences. Why Advertising Research Matters Advertising research is the backbone of effective marketing

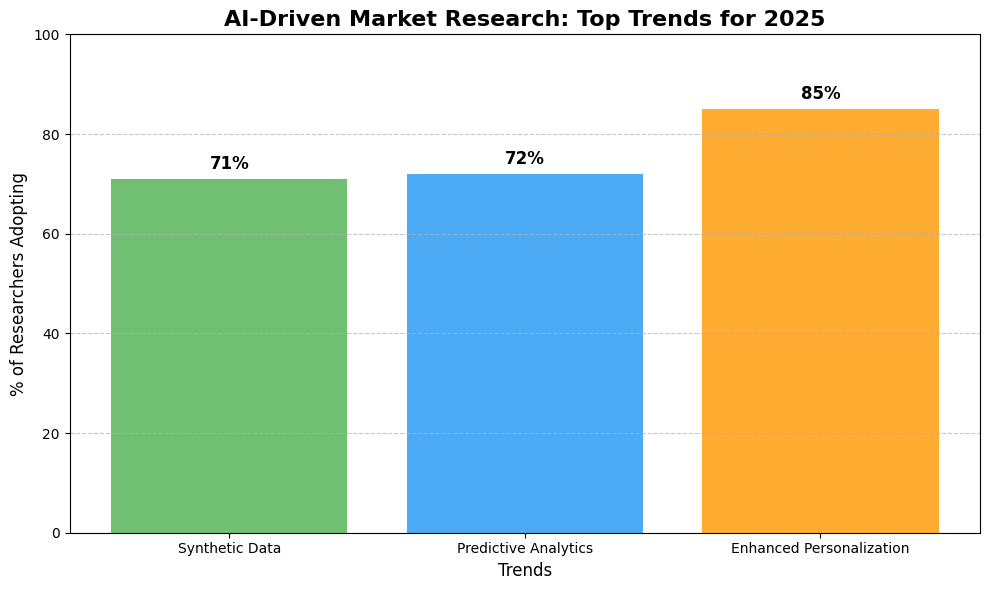

AI-Driven Market Research: Top Trends for 2025

The world of market research is undergoing a seismic shift, and 2025 is set to be a landmark year. With Artificial Intelligence (AI) at the forefront, researchers are now equipped with tools that make insights faster, more accurate, and actionable. From synthetic data to predictive analytics, AI is reshaping the

Unlock Insights with Cogentix Research: India’s Premier Survey Panel and Advertising Research Company

In today’s data-driven world, understanding consumer behavior, market trends, and advertising effectiveness is essential for businesses aiming to stay competitive. At Cogentix Research, we specialize in providing cutting-edge survey panel and advertising research solutions, helping organizations in India make informed decisions with precision and confidence. Why Choose Cogentix Research? With

Market Research Missteps: Common Pitfalls and How to Avoid Them

Market research is an essential component of business strategy that provides critical insights into consumer behaviors, market trends, and competitive landscapes. However, even the most well-intentioned market research initiatives can encounter pitfalls that skew results and lead to poor decision-making. This blog explores common market research missteps and offers strategies

From Clicks to Conversions: Understanding the Digital Consumer’s Journey

In today’s rapidly evolving digital landscape, understanding the journey from initial consumer interest (clicks) to the ultimate goal of conversion is crucial for businesses aiming to optimize their online strategies. This blog delves into the nuanced steps of the digital consumer’s journey, highlighting effective strategies for capturing and converting online

As data becomes the cornerstone of market research, ensuring its security and integrity has never been more critical. Blockchain technology, with its decentralized and immutable ledger, offers a promising solution to many of the data security challenges that the market research industry faces today. This blog explores the implications of

In today’s digital age, social media platforms are not just communication tools but vital sources of consumer insight. Social media listening has emerged as a cornerstone technique in market research, revolutionizing how companies understand and engage with their audiences. This blog explores why social media listening is integral to contemporary

The Impact of Economic Shifts on Consumer Behavior

Economic shifts significantly influence consumer behavior, affecting how, why, and when people decide to spend their money. From recessions to booms, every fluctuation in the economy provides valuable insights into consumer priorities and market trends. This blog explores how different economic conditions impact consumer behavior and what businesses can learn

Dive into Insights Innovation at IIEX Asia Pacific 2024

In today’s data-driven world, staying ahead of the curve in the insights industry is crucial for businesses of all sizes. As the need for actionable insights intensifies, industry professionals are constantly seeking out opportunities to learn about the latest trends, network with peers, and gain valuable knowledge to help their

Navigating the Green Revolution: How Sustainability is Shaping Consumer Preferences in 2024

The year 2024 marks a pivotal moment in the consumer market, driven by a significant shift towards sustainability. This movement isn’t just a fleeting trend; it’s a profound evolution of consumer consciousness that’s reshaping the way brands and market researchers approach the marketplace. As eco-consciousness moves from the fringes to

The Rise of Voice Search: Revolutionizing Market Research Strategies in 2024

In the digital landscape of 2024, voice search isn’t just an emerging trend; it’s a fundamental shift in how users interact with technology and search for information. This seismic change is compelling market researchers to rethink and adapt their strategies to harness the power of voice-driven data. With the convenience

Market Research Best Practices: Unveiling the Secrets to Success

IntroductionIn today’s fast-paced and ever-evolving business landscape, staying ahead of the competitionrequires more than just a great product or service. To make informed decisions and develop winningstrategies, companies must invest time and resources into effective market research. Marketresearch serves as the cornerstone for understanding customer preferences, industry trends, andcompetitive landscapes.

The Thriving Herbal Supplement Market in the USA

The United States has long been a hub for health and wellness trends, and the herbal supplement market is no exception. In recent years, there has been a noticeable surge in the popularity of herbal supplements among American consumers. This growing interest is driven by a variety of factors, including

Ethical Diversity in Market Research: A Transformative Approach

The events surrounding the 2020 George Floyd incident significantly impacted US brands and industries, exposing a longstanding tension within market research. On one side, marketers demand more input from Black and brown consumers. On the other, the call for multicultural researchers to provide nuanced insights grows louder. Yet, beneath these

AI-Driven Transformation: Enhancing Efficiency and Innovation in FMCG

The Fast-Moving Consumer Goods (FMCG) sector has always been characterized by its competitive nature and the need to adapt swiftly to changing consumer preferences. In today’s digital age, companies in this sector are turning to cutting-edge technologies to gain a competitive edge. One such technology making waves in the FMCG

Unveiling Market Insights: The Power of Comprehensive Market Research

In today’s dynamic business landscape, staying ahead of the competition requires more than just intuition. It demands an in-depth understanding of market trends, consumer preferences, and emerging opportunities. This is where market research plays a pivotal role. A strategic market research company serves as a compass, guiding businesses towards informed

The Soaring Trajectory of the Digital Education Market: Projected Worth of $57.19 Billion Globally by 2028 at a Remarkable CAGR of 28.70%

The global education landscape has undergone a revolutionary transformation in recent years, largely driven by technological advancements. One of the most notable shifts has been the rapid growth of digital education. This mode of learning, which encompasses online courses, virtual classrooms, e-learning platforms, and educational apps, has witnessed an unprecedented

Market research plays a crucial role in guiding business decisions and strategies. It provides valuable information about consumers, competitors, and industry trends. However, raw data alone is not enough. To truly harness the power of market research, one must master the art of data analysis. In this blog, we will

Maximizing ROI with Effective Market Research Strategies

In today’s competitive business landscape, organizations face the constant challenge of maximizing return on investment (ROI) while minimizing risks. One powerful tool that can help achieve this goal is effective market research. By harnessing the insights gained through thorough research, businesses can make informed decisions, allocate resources wisely, and ultimately

Preventing Fraud in Market Research: A Never-Ending Battle

Fraud is a continuously evolving issue, and it affects various industries worldwide. In recent years, the marketresearch industry has been dealing with fraudulent activities, especially when it comes to collecting data throughsurveys. Therefore, it is crucial to develop the right tools and strategies to prevent fraud, which is a continuouseffort.Fraudsters

Ensuring Data Quality in Market Research: 5 Key Principles to Combat Survey Fraud and Improve Results

The importance of data quality in the market research industry is growing, and it is no surprise that it is consideredthe most crucial factor when choosing a market research partner or supplier (GRIT Report 2020). To addressconcerns regarding survey fraud and poor quality data, here are five key principles that

Five Steps to Better Data Quality

In the information age, data is the calorie that drives business decisions. Just as there are good calories and bad calories, not all data is equal. As more and more companies use data to drive their decision-making processes, getting quality data is crucial to their success. Data science has been

Competitive Analysis: How to Analyze Your Competitors to Grow Your Business

When you’re running a business, it’s important to know who your competition is and what they’re up to. After all, if you don’t know what your competitors are doing, how can you stay ahead of the game? Competitive analysis is the process of identifying and assessing your competitors in order